Secrets About Order Blocks

- Posted on 03 January, 2025

- forex trading

- By Somto Daniel

Imagine the market as a giant ocean, with waves representing price movements. Now, hidden beneath the surface are these things called "order blocks" – think of them as underwater volcanoes that can suddenly erupt and cause massive waves.

What exactly are they?

In simple terms, order blocks are like footprints left by big players in the market, such as banks or hedge funds. These institutions don't just buy or sell everything at once; they place large orders that can take time to fill. This creates a zone on the price chart where a lot of buying or selling activity has happened.

Why are they important?

These zones become significant because the market often remembers them. When the price revisits an order block, it's like the market is saying, "Hey, something important happened here before!" This can lead to a reaction, causing the price to bounce off the order block or even reverse direction.

Related stories:

👉🏽Understanding Risk Management

👉🏽13 Pitfalls To Avoid In Forex Trading

👉🏽7 Questions To Ask Be For Choosing A Forex Broker

How do we spot them?

Here's where it gets interesting. We look for a few key things:

- Strong Impulsive Moves: Imagine a sudden, powerful wave in our ocean analogy. This is what we want to see on the chart – a sharp price movement that breaks away from the norm.

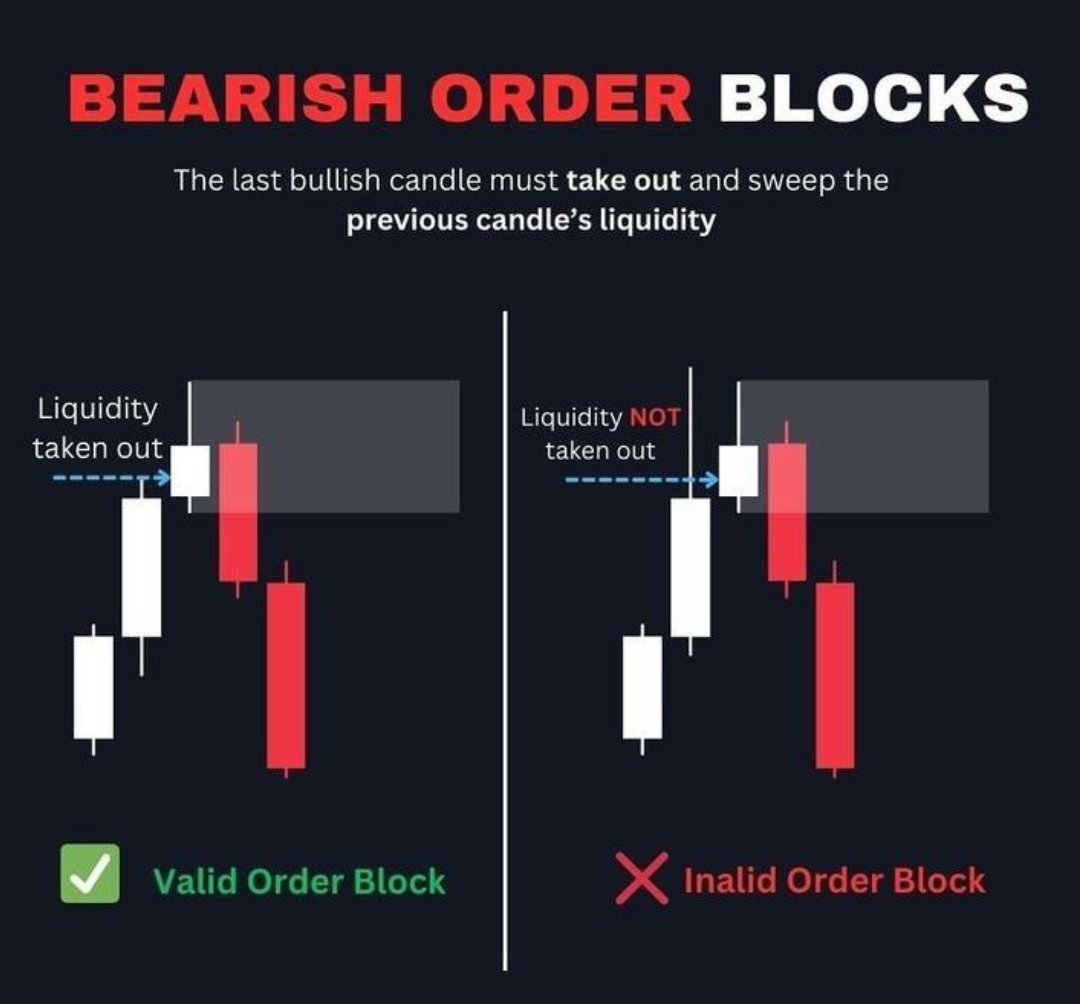

- The Last Opposite Candle: Before this big move, there's usually a final candle that goes in the opposite direction. This is often the order block itself. It's like the last gasp before the volcano erupts.

- Consolidation: Sometimes, before the big move, the price might hang around in a tight range for a bit. This is like the pressure building up inside the volcano.

Trending Now: 👉🏽You Will Start Making Money In Trading

How do we use them in trading?

Traders use order blocks to identify potential areas for:

- Entries: If the price returns to a bullish order block (where a lot of buying happened), it could be a good place to enter a long (buy) position.

- Exits: Conversely, if the price reaches a bearish order block (where a lot of selling happened), it could be a good place to exit a long position or even enter a short (sell) position.

- Stop-Loss Placement: Order blocks can also help traders decide where to place their stop-loss orders to limit potential losses.

Important things to remember:

- Not all order blocks are created equal: Some are stronger than others. The context of where they form in the overall market structure is crucial.

- They're not foolproof: Like any trading tool, order blocks are not always accurate. It's important to use them in conjunction with other forms of analysis.

- Practice makes perfect: Learning to identify and trade order blocks takes time and practice.

Order blocks are like hidden clues left by big market players. By learning to spot them, we can gain valuable insights into potential price movements and make more informed trading decisions. It's like having a secret map to navigate the market ocean!

You might also like:

👉🏽The Forex Trader's Mindset: 12 Key Traits

👉🏽How many Trading days In A Year

👉🏽Pay Yourself In Forex Trading

0 Response